Would the Company Want Derrick to Pursue This Investment Opportunity

Derrick is considering a capital budgeting project that would require a 4450000 investment in equipment with a useful life of five years and no salvage value. Holston Companys discount rate is 15.

Managerial Acct Quiz 19 Pdf 48 Course Hero

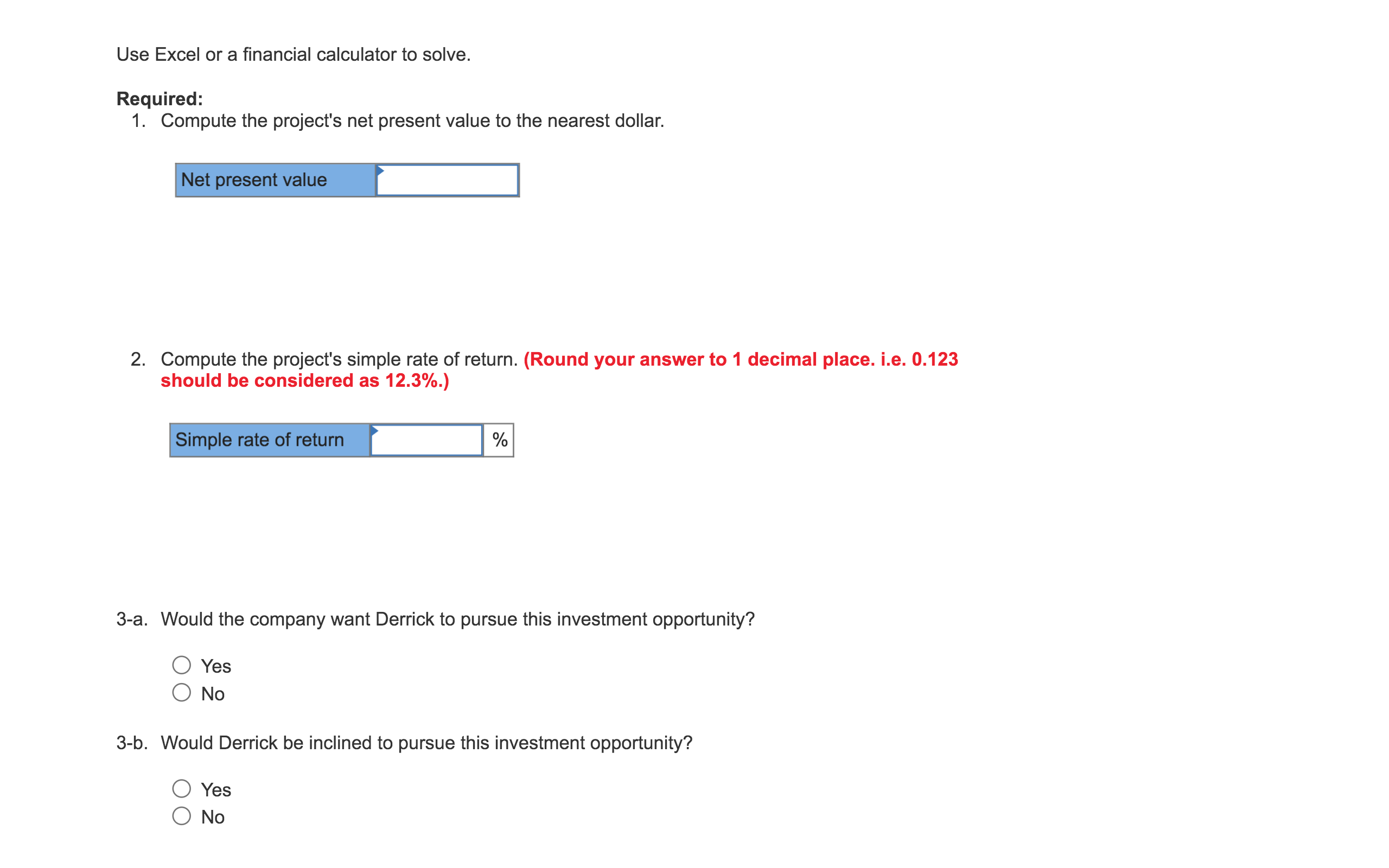

The company would want Derrick to pursue the investment opportunity because it has a positive net present value of 17700.

. Would Derrick be inclined to pursue this investment opportunity. EXERCISE 8-10 Basic Net Present Value Analysis LO 8-2 Kathy Myers frequently purchases stocks and bonds but she is uncertain how to determine the rate of return that she is earning. Round your answer to 1 decimal place.

Would the company want Derrick to pursue this investment opportunity. We review their content and use your feedback to keep the quality high. Derrick is considering a capital budgeting project that would require a 4200000 investment in equipment with a useful life of five years and no.

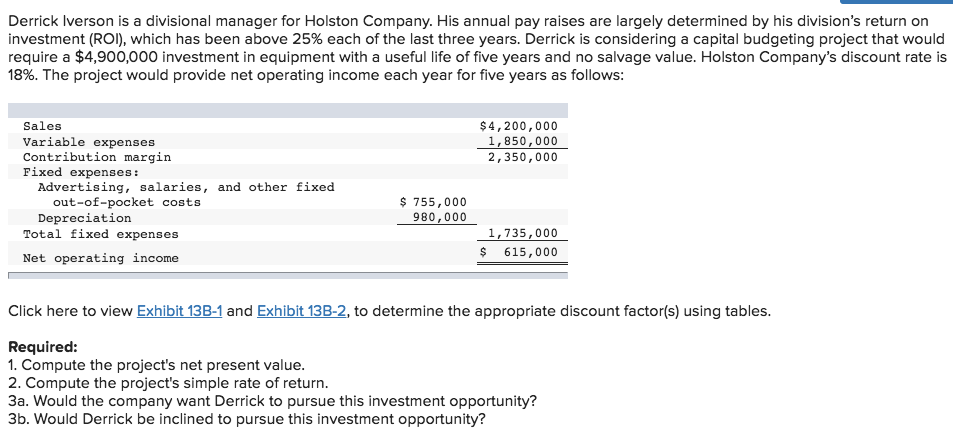

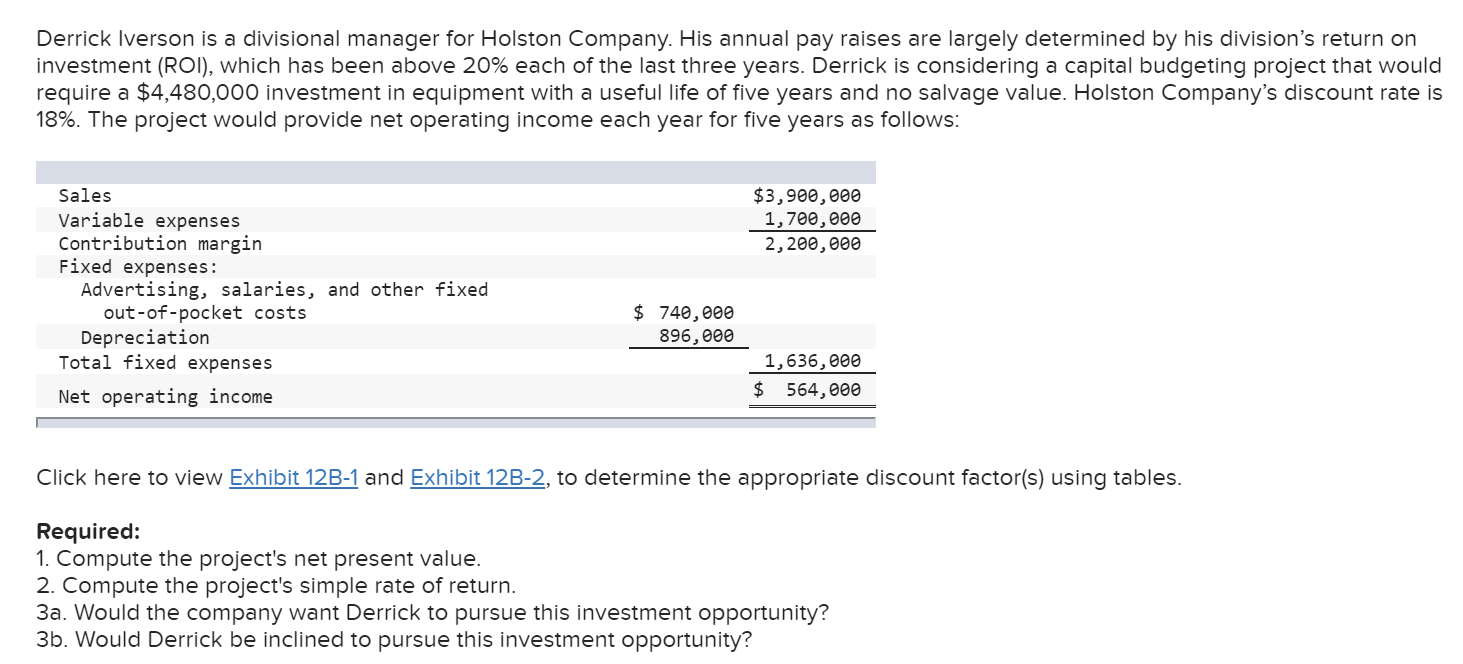

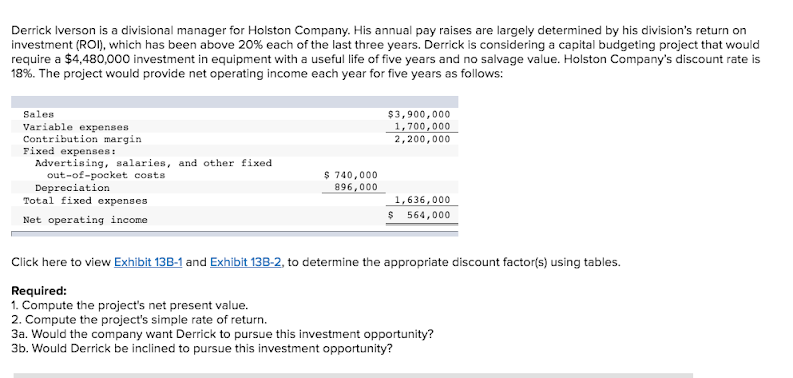

The project would provide net operating income each. Holston Companys discount rate is 18. His annual pay raises are largely determined by his divisions return on investment ROI which has been above 20 each of the last three years.

Derrick is considering a capital budgeting project that would require a 4000000 investment in equipment with a useful life of five years and no salvage value. Would the company want Derrick to pursue this investment opportunity. The project would provide net operating income each.

Derrick is considering a capital budgeting project that would require a 3080000 investment in equipment with a useful life of five years and no salvage value. 1666 points Complete this question by entering your answers in the tabs below. Experts are tested by Chegg as specialists in their subject area.

Derrick Iverson is a divisional manager for Holston Company. Derrick is considering a capital budgeting project that would require a 4140000 investment in equipment with a useful life of five years and no salvage value. Compute the projects simple rate of return.

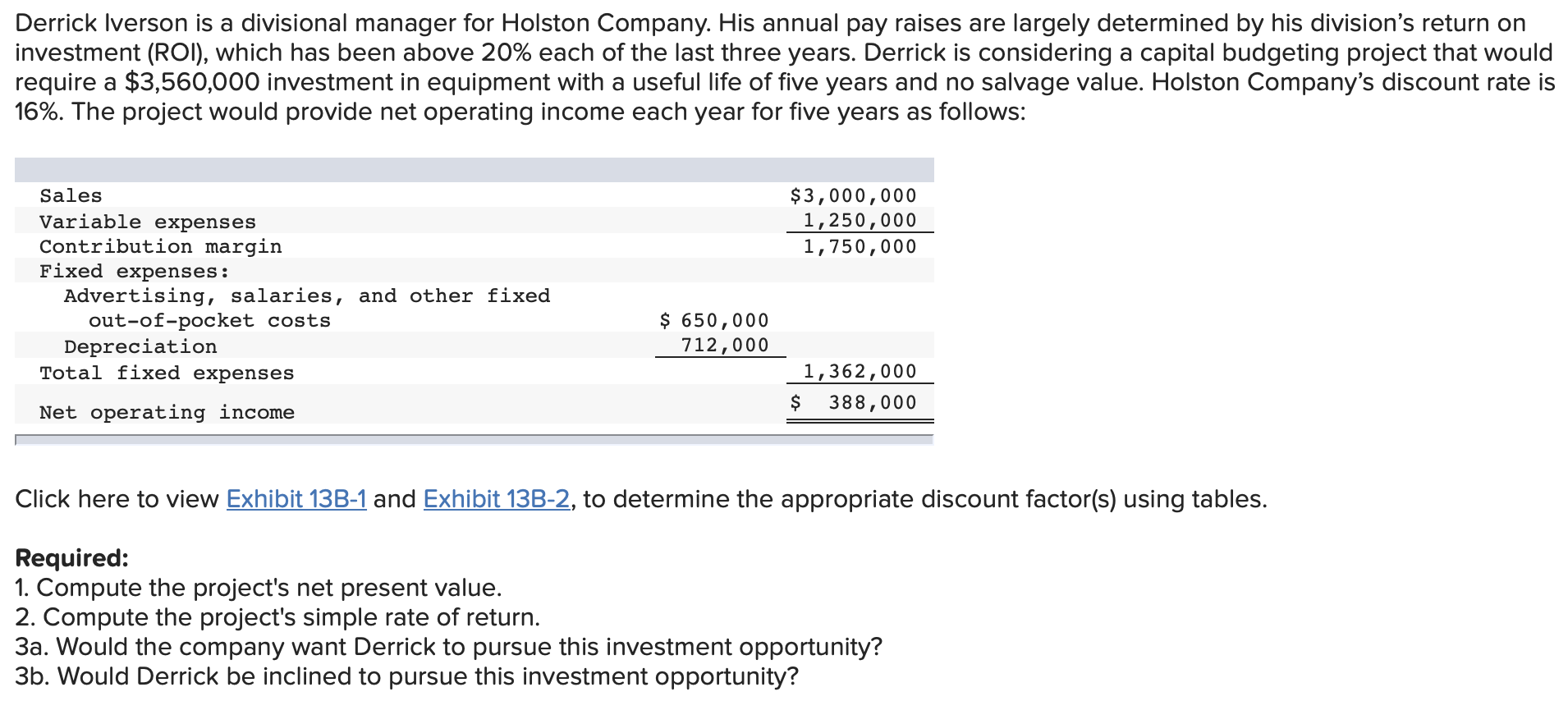

Derrick is considering a capital budgeting project that would require a 3560000 investment. His annual pay raises are largely determined by his divisions return on investment. Derrick is considering a capital budgeting project that would require a 3000000 investment in equipment with a useful life of five years and no salvage value.

Holston Companys discount rate is 15. Would Derrick be inclined to pursue this investment opportunity. Would Derrick be inclined to pursue this investment opportunity.

The project would provide net Operating Income each year for five years as follows. Would Derrick be inclined to pursue this investment opportunity. Would the company want Derrick to pursue this investment opportunity.

0123 should be considered as 123 3-a. Derrick Iverson is a divisional manager for Holston Company. Would Derrick be inclined to pursue this investment opportunity.

Holston Companys discount rate is. Ashish answered on January 21 2021. 1 Answer to Derrick Iverson is a divisional manager for Holston Company.

5 Ratings 10 Votes Answer. The company would want Derrick to pursue this investment opportunity because it has a positive net present value of 91311. Would Derrick be inclined to pursue this investment opportunity.

Derrick is considering a capital budgeting project that would require a 3000000 investment in equipment with a useful life of five years and no salvage value. Would the company want Derrick to pursue this investment opportunity. Derrick is considering a Capital Budgeting project that would require a 3000000 investment in equipment with a useful life of five years and no salvage value.

However Derrick might be inclined to reject the opportunity because its simple rate of return of 10 is well below his historical return on. Depreciation 670000 Net Cash. EBook Hint Reg 1 Reg 3A Reg 38 Pin 012 should be considered as References Compute the projects simple rate of return.

However Derrick might be inclined to reject the opportunity because its simple rate of return of 134 is well below his historical return on. However Derrick might be inclined to reject the opportunity because its simple rate of return of 124 is well below his historical return on investment ROI of 25. Would the company want Derrick to pursue this investment opportunity.

Solution for Derrick Iverson is a divisional manager for Holston Company. Derrick is considering a capital budgeting project that would require a 4650000 investment in equipment with a useful life of five years and no. No The company would want Derrick to pursue the investment opportunity because it has a positive net present value of 63320.

The company would want Derrick to pursue the investment opportunity because it has a positive net present value of 56135. His annual pay raises are largely determined by his divisions return on investment ROI which has been above 20 each of the last three years. Annual net Cash Inflow Net Operating Income 610000 Add.

His annual pay raises are largely determined by his divisions return on investment ROI which has been above 25 each of the last three years. Who are the experts. A positive net present value is an indicator that this investment would increase the value of the company and thus increase the investors wealth.

Derrick Iverson Is A Divisional Manager For Holston Company His Annual Pay Raises Are Largely Determined By His Divisi Homeworklib

2 Derrick Iverson Is A Divisional Manager For Holston Itprospt

Solved Derrick Iverson Is A Divisional Manager For Holston Chegg Com

Solved Derrick Iverson Is A Divisional Manager For Holston Chegg Com

Exercise 13 9 Net Present Value Analysis And Simple Rate Of Return Lo13 2 Lo13 6 Derrick Iverson Is Homeworklib

Answered Derrick Iverson Is A Divisional Manager Bartleby

Managerial Acct Quiz 19 Pdf 48 Course Hero

Derrick Iverson Is A Divisional Manager For Holston Company His Annual Pay Raises Are Largely Determined Homeworklib

Derrick Iverson Is A Divisional Manager For Holston Co Itprospt

Solved Please Do Not Leave Anything Unanswered And Try As Much As 1 Answer Transtutors

Acct 346 Homework Week 8 Docx Acct 346 Homework Week 8 Derrick Iverson Is A Divisional Manager For Holston Company His Annual Pay Raises Are Largely Course Hero

Managerial Acct Quiz 19 Pdf 48 Course Hero

2 Derrick Iverson Is A Divisional Manager For Holston Itprospt

Derrick Iverson Is A Divisional Manager For Holston Company His Annual Pay Raises Are Largely Determined Homeworklib

Solved Derrick Iverson Is A Divisional Manager For Holston Chegg Com

Asia Pacific Reits Manulife Investment Management

Derrick Iverson Is A Divisional Manager For Holston Company His Annual Pay Raises Are Largely Brainly Com

Solved Derrick Iverson Is A Divisional Manager For Holston Chegg Com

Comments

Post a Comment